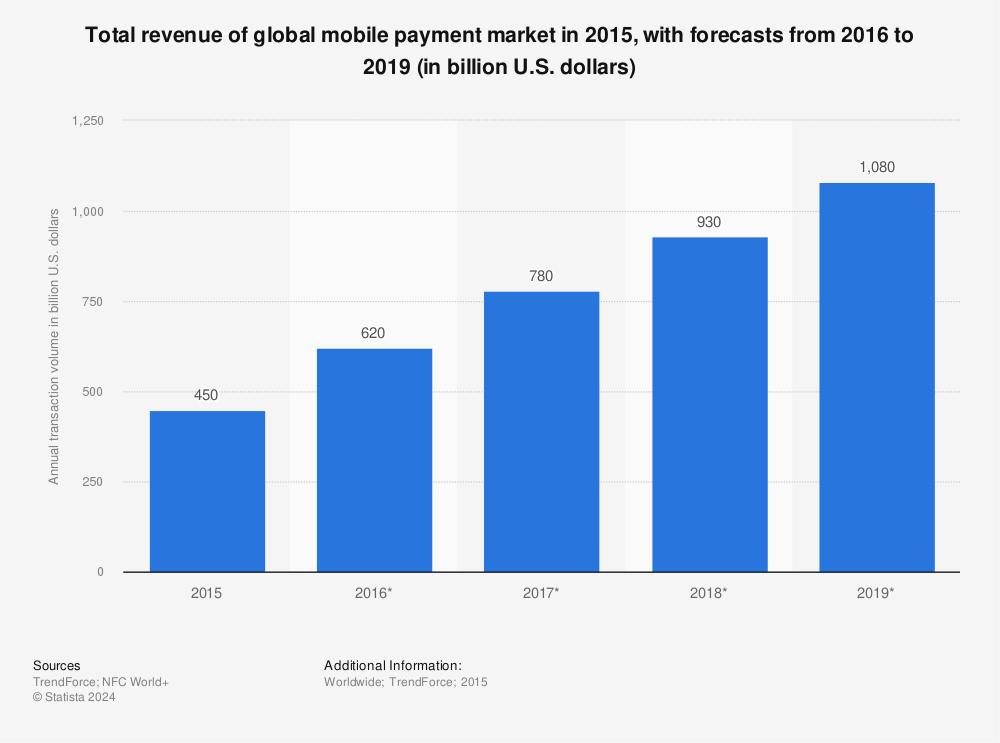

When it comes to the question of mobile payment for restaurants, the hard part isn’t deciding to implement, but rather determining the best path to follow. Especially, with statistics like those depicted in the infographic below.

Mobile payment transactions are projected to better than double from 2015 – 2019, thereby eclipsing $1 trillion in nominal value. That volume of transactions would make mobile payments the 25th largest economy in the world -- just ahead of Pakistan and larger than 203 other sovereign nations.

Couple this with the affection that Millennials have for everything mobile and the security of not having the guest’s credit card leave the table and the evidence is clear.

Simply stated: You can’t continue to ignore this valuable convenience for both your guests and, as it turns out, your service quality.

The goal of this post is to give you some guidelines so you can be prepared to choose the best solution for your location. We have focused here on three key questions you need to answer before you choose the right provider for your location.

Is your POS supported by the mobile payment providers you are entertaining?

The importance of this can’t be underestimated. Most mobile pay providers are already connected with the big players like Micros and Aloha.

But if you use a lesser installed POS system, it could be an impediment. This is less of an issue if you use a separate terminal to process your payments versus an integrated solution with your POS.

How do you want mobile payments to fit in your service cycle?

This is the first and most important decision you must make. How you want mobile payment to fit into your operations will dictate which mobile payment providers will work best for you.

Start by thinking in terms of the guest experience. When your guests are ready to leave, how are you currently delivering the guest check? If you are like most full-service restaurants, the check is delivered, processed and returned by the server assigned to the table. Do you want to change this experience or maintain it?

Each of the three types of mobile payment solutions described below have different impacts on the service cycle and guest experience. It’s your job to determine which fits your vision most closely.

Restaurant Specific Mobile Apps

These are solutions like MyCheck and TabbedOut -- apps that allow a guest to register one of their credit cards. The app communicates with your POS via a prebuilt integration.

Pros: As an affiliated restaurant, there are rewards and communications opportunities, as well as solid metrics about guest behavior.

Cons: They aren’t as widely known and require that the guest enter a code to access their check.

Consequently, this solution behaves much like your existing guest check presentation. The guest is delivered their check by the server, enters the code, and then manages their check based on the mobile payment app you employ.

Nationally Recognized Payment Systems

These are the integrations you see at major retailers like ApplePay and SamsungPay. They require POS integration and a specific piece of equipment that is either Bluetooth or Near Field Communication (NFC) enabled. This device is how your POS accesses the payment from the payment service. It’s more seamless in a QSR/counter service setting, but there are integrations with mobile devices that can be brought table-side, as well.

Pros: The systems are more widely used and recognized by your guests. They don’t require the guest to add a check specific code.

Cons: They do require a specific piece of equipment to function.

Also, this transaction process is more similar to the payment model used for service in Canada and Europe, where the server delivers the check and then returns with a device to process the payment. It’s a disruption to the typical checkout transaction that happens in the US.

Table-side Devices with Mobile Payment Capabilities

There has been a clear explosion of tablet solutions for both ordering and payments over the past few years. However only a couple of those solutions actually support mobile wallet payments.

Two that come to mind are Ziosk and the RAIL (no relation) from TableSafe. These products offer the best of both worlds by not disrupting the traditional service experience and providing multiple options for payment.

The RAIL, for example, is a device that is delivered in lieu of a paper check. The guest can process at their leisure, control the payment method and close out. Ziosk is a standalone tablet device that is placed at each table. It does much the same as the RAIL, but also includes ordering and some entertainment features.

Pros: The service experience is not disrupted and the devices support all forms of payment.

Cons: These products are not free, although the resulting metrics of increased table turns and improved guest service mitigate those costs significantly.

In the end, each of these products neatly deliver mobile payments, but the questions must be approached from what impact you want to have on your service cycle with new technology.

What is my maximum budget for implementing a mobile pay solution?

There are a variety of budgetary impacts associated to mobile wallet payments. You will need to factor whether the product you want charges a per transaction fee, a monthly processing fee, or uses a recurring device lease/access fee. This is where any commitment to mobile payments gets tested.

Statistics like 40% faster table turns, 5% sales increases and higher added gratuities all need to be considered when you are calculating your real cost of implementation. The key is balancing implementation and equipment costs with real financial improvements to your operation.

As long as the impact is net neutral or positive you should consider it a win. You are improving your service and the guest’s overall experience.

So there you have it! With those three questions answered, you have the basis for choosing a mobile wallet payment solution. Mobile payment is here to stay and will only become more popular as the Millennial generation flexes it’s buying power.